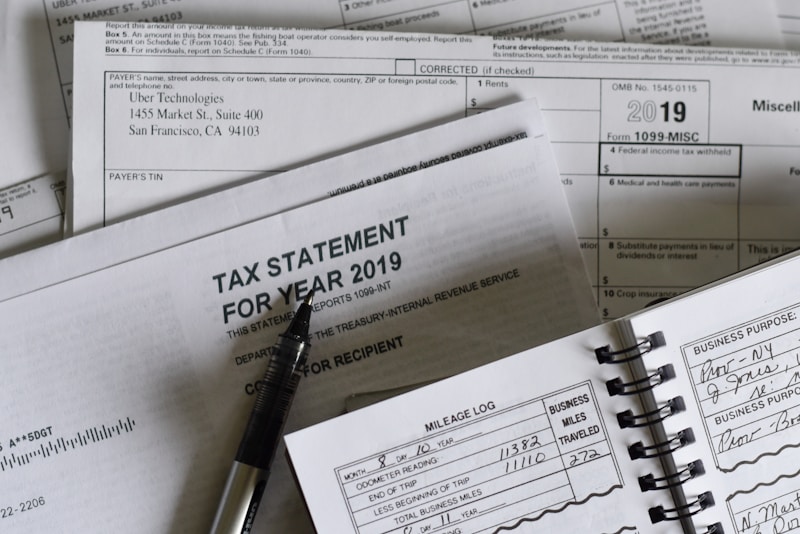

Introducing: Common Business Tax Deductions – A Complete Guide

Hey entrepreneur! 🙌

This comprehensive, beginner-friendly guide will walk you through the most common — and most overlooked — tax deductions you’re probably already eligible for. You’ll learn how to keep more of your hard-earned income while staying 100% IRS-compliant.

📘 What’s Inside:

A clear breakdown of legit business write-offs (no jargon, just straight talk)

The difference between what you can deduct and what you should

Easy-to-understand examples for home office, meals, travel, marketing, and more

Audit-safe tips for tracking expenses and staying organized year-round

🎯 Perfect For:

✔️ New business owners unsure what “counts”

✔️ Side hustlers who want to stop leaving money on the table

✔️ Solopreneurs looking to feel confident at tax time

💥 Why You Need This:

Taxes don’t have to be scary — or expensive.

When you know what deductions apply to your business, you gain power. Power to grow. Power to plan. And power to legally lower your tax bill — sometimes by hundreds or even thousands.

This $28 guide will pay for itself many times over with the savings you unlock.

✅ Grab Your Copy Instantly — Just $28

Whether it’s your first year in business or your fifth, this PDF will give you the clarity you need to stop guessing and start deducting with confidence.

👉 Click to buy now — and keep more of what you earn!