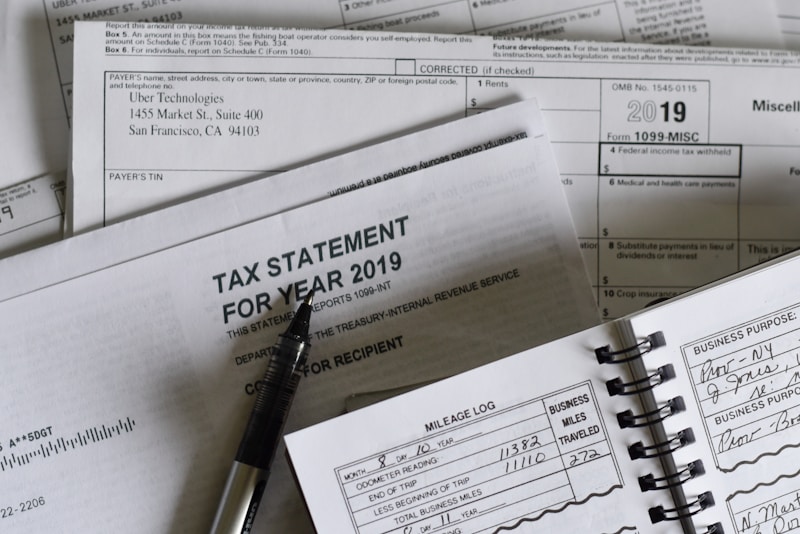

🗂️ Tame the Paper Pile — and Stay on the IRS’s Good Side

Introducing: IRS Recordkeeping Guide – What Every Taxpayer Needs to Know

Your complete guide to organizing, storing, and mastering the records that keep your business audit-ready and stress-free.

Hey, smart business owner 👋

You’ve probably asked: “Do I really need to keep this receipt?”

With this guide in your hands, you’ll finally have the definitive answer — and so much more.